- Get Out of Debt

- Maximize Your Credit Score

- Save for retirement

Stop Wondering Where Your Money Went

Hey there! We Have Got to Talk About Your Money

Yes, your money. The thing you spend so much of your time thinking about and yet still don’t seem to ever have enough of.

You stare up at the ceiling in the middle of the night, overcome with fear that this will be the month you aren’t going to make it. This isn’t how you thought your life would be.

You should be taking vacations, spoiling your loved ones silly, and looking forward to retirement. Instead you’re in debt over your head, and you can’t seem to find a way out.

And retirement? Well, at this rate you’re sure you’ll be working forever.

Hiding From Your Finances Isn't Helping

I remember what it’s like to be so terrified to realize what you owe, that you just don’t even look at your balance. But ignoring your debt isn’t getting you any closer to paying it off!

It’s time to get a clear picture of where you are, so you can get a plan to where you want to be!

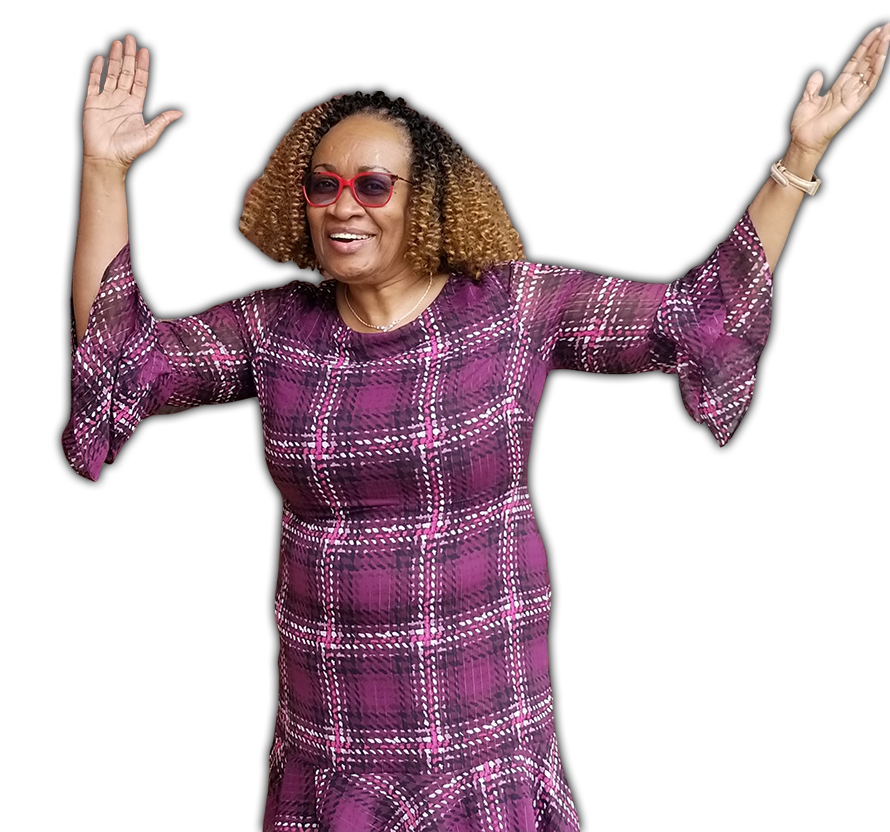

I’m Dr. Sev, and I help clients like you face their financial reality so they can change their financial future.

Change Your Thinking

Change Your Spending

Change Your Future

You need a plan – a plan to pay off your debt and save for your future.

But you don’t need someone else’s baby steps; you need a plan that actually works for your particular life. Because your life and circumstances are different than everyone else’s.

That’s why I put together strategic plans for my clients to achieve their financial goals (not what some so-called money guru tells them they need to do).

We then uncover how they’ve been thinking about money so they don’t end up back in the same spot they are in now.

Your future doesn’t have to look like your past if you change your present. With the right plan and accountability, you can put your financial future on a new trajectory.

What Clients Say

Anything's Possible with a Plan

Book a Call

Choose a time on my calendar. Begin with a complimentary 15 minute Consultation Call where we’ll discuss your most pressing money concerns and explore whether my approach aligns with your goals.

Get a Plan

Get a personalized plan using strategies you can actually put into place to turn around your specific financial situation.

Live Free

With accountability and ongoing support, you can find the financial freedom you’re looking for in less time than you think!

FAQ

Are you a financial advisor? How is working with you different?

No, I am not a financial advisor. I’m an Accredited Financial Counselor® which means I am a fiduciary and am committed to doing what is best for you. I help you create a plan for you to follow to achieve your financial goals, but I do not make investments for you or give tax advice. I am happy to refer you to someone in my network for other financial services.

What services do you provide?

Financial education & coaching! I can help you get your financial bearings, tackle an immediate financial crisis, overcome debt, grow your savings, manage student loans, grow your credit scores, build a sound financial foundation, and more. I also provide financial education workshops to churches, organizations and small to mid-sized businesses.

What can I expect from a session with you?

Empathy & no judgement! Working with me is all about creating a safe, non-judgmental space where we tackle your financial goals together. We start with where you are financially. Then project where you want to be based on your values and goals. We also include some money mindset assessments in our sessions. We’ll review your unique situation, break down any obstacles, and map out a plan that fits your life. My goal is to empower you with practical tools and a mindset shift so you can FIRE me and move forward with confidence and clarity.

What if I feel embarrassed or ashamed about my financial situation?

We all have a past! I totally get it. Talking about money can feel uncomfortable, especially if you’re carrying guilt or shame. But here’s the thing: We all have a past, and it’s never too late to start fresh. When we work together, you won’t be judged. My job is to help you move forward, not dwell on what’s behind you. We’ll focus on practical steps, self-compassion, and growth.

Is there a plan all of your clients have to follow?

No cookie cutter, baby steps here! Each of my clients is different, with different goals, personalities, and life circumstances. Personal finance is just that – personal! I create a custom plan for each client based on extensive research into their unique situations.

Do you only work with women, or can men work with you too?

Everyone deserves financial empowerment. While my mission is to support women, especially those starting over, I believe that anyone—regardless of gender—can benefit from a healthy relationship with money. If you feel aligned with my approach, I’d be happy to work with you too!

Do you offer payment plans or sliding scale pricing?

Yes, I offer flexible payment options (under special circumstances) because I believe financial empowerment should be accessible to everyone. If you’re concerned about affordability, just reach out and we can discuss a plan that works for you. Let’s make sure we can get you the help you need without stress.

Can I still use my credit cards?

Maybe. I am not against using credit cards or loans wisely, if that is the right decision for your unique circumstances.

Why should I consider working with a financial counselor when I could just read a book or take an online course?

Accountability is key to success. Have you ever read a book or taken a course, and walked away and did nothing with what you learned? Knowledge is great, but transformation is better. A trusted guide can help show you what to do, how to do it, and then hold you accountable to actually doing it!