In 2014, I made the best financial mistake; giving back my home to the mortgage company. Yep, you read that right! At the time, I was devastated. But out of ashes, came beauty: The beauty of practical experience that I can now share with my readers. Yeah!

I have always had a passion for financial education and an affinity with numbers; teaching financial literacy at church and via various groups to which I belonged and tutoring Algebra, Accounting, and Calculus in college. By nature, I was very thrifty and responsible with my finances; so much so that my dad added me to his bank account when I was 14 years old. Because as he put it, I was very responsible. 🙂

As an adult, I always paid my bills on time and never really racked up any major debt. So, by default, I had a pretty good credit score of close to 800 by the time I walked away from my home. I purchased the home in 2003 and it was tough to walk away after making 11 years of on-time payments. Some months, I even paid extra toward the principal.

However, a divorce and a non-cooperative spouse left me with little options. On the advice of my lawyer and mentors, I stopped paying the mortgage, moved out with my daughter, and rented a place of my own. By the time I went back to court to get my ex-spouse to vacate the property, my credit had dropped to the 500s on the basis of the missed mortgage payments.

I was no stranger to home ownership, having bought my first home as a single woman. A home I later sold at a loss. So, why was THIS the best financial mistake?

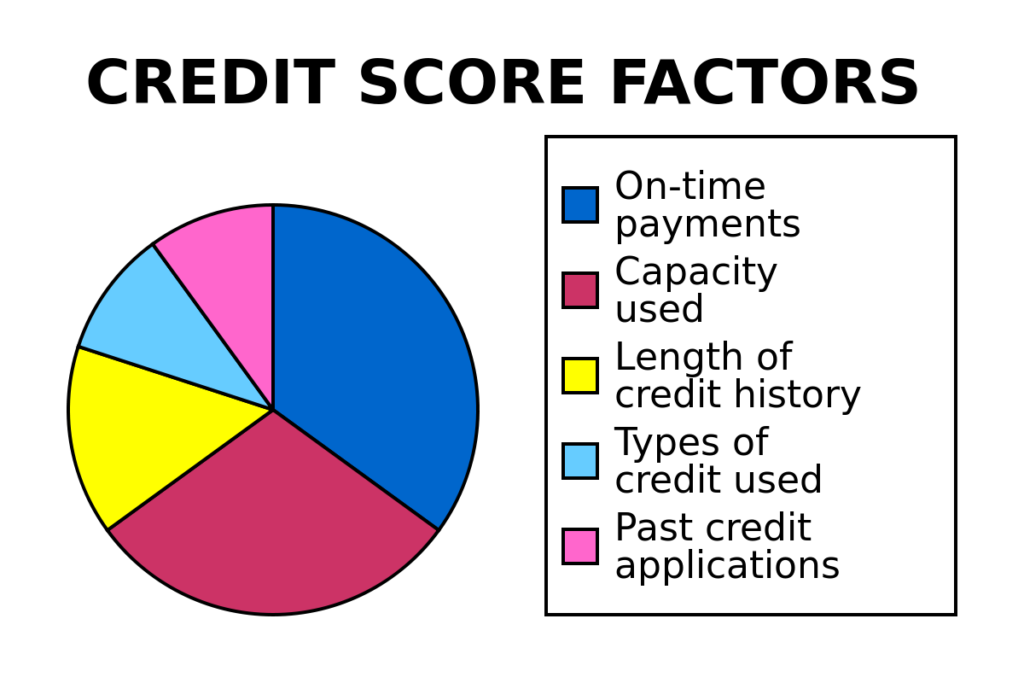

It forced me to be specific and intentional when looking at my credit score and its various components. And now YOU are the beneficiary of the pain and bounce back of that mistake. Awesome! Right?!

So now, I needed to explore each component of my credit score and apply the principles I had been teaching all these years.

Today, my score has climbed back into the mid 700s and will continue to climb as I do the work. Here’s what I did to ensure that my score grew:

- 35% of credit scores come from on time payments.

- I continued to pay all bills on time; except the pesky late payments continue to show up on my credit report.

- 30% of credit scores come from credit utilization.

- I ensured my credit cards** were always less than 10% of their limits.

- I paid the balance on each card before the statement date (not due date) so that when the balances are reported to the bureaus, it shows zero or very low balances.

- The credit card companies typically report the balances when they issue the statements which of course is earlier than the due dates.

- 15% of credit score is due to length of credit history.

- I used to close credit accounts willy-nilly; however, now I keep all older accounts open.

- I also don’t open credit, especially those store card offers of 10% at the register because they will quickly reduce my credit age.

- Credit age average is calculated using the years of all cards divided by the number of cards. Therefore if I had a card for 10 years and one card for one year, my score would be 5.5 years (10+1 divided by 2). If I were to acquire 3 additional cards, my credit age would now be 2.8 (10+1+1+1+1 divided by 5).

- 10% of credit score is due to the type of debt or credit mix.

- I kept a mix of installment and revolving credit accounts. Most notably, student loans (Like I had a choice with evil student loans. Ha! Ha!) and credit cards.

- 10% of credit score is due to recent inquiries.

- Hard inquiries are where a company checks your credit before making a decision to lend money that you applied for.

- Two or more hard inquiries will lower your scores. Although, not by much.

- Hard inquiries fall off after two years.

- Soft inquiries will not impact your score. A soft inquiry is where a company checks your credit as a background check or to see if they can send you pre-approved credit offers.

**Use credit cards conscientiously. If you have a spending problem, I suggest you not use credit cards or that you engage the service of a financial coach/accountability partner to help you manage your credit responsibly.

34 Comments

Thanks so much for the information on how credit scores are calculated— l did not know until I read your blog- This was an education for me in knowing how credit card/ score impact economic freedom on a personal level. Thanks—

Thanks for reading. I’m glad you found it beneficial.

Great blog!! Thanks for the breakdown of the credit score calculation. Can’t wait for the next one!!

Thanks for reading. I hope the contents continue to be informative.

Indeed I enjoy reading your blog. I remember back at Valencia College how responsible you were with your finances. You are in a mission to educate folks who cannot control or manage their finances. May God bless in this mission.

Hi Phil, thank you for reading the blog. Yes, I’ve been a “teacher” for a long time. 🙂 Thanks for the blessing.

WoW! Being credit conscience, at least so I thought.. I never understood the credit break down and why I would receive an alert that my file had changed when I’m ALWAYS on time again, so I thought. Thanks for the enlightening, I will definitely be making true on time payments going forward and bring my score back up! Looking forward to the next great read😉

Mimi, thanks for reading and for your comment. 😊

It makes my heart happy that the post was beneficial. Please share the website with family and friends who may benefit.

This was a long time coming, I’m truly glad to see all that you have worked so hard on come to realization. The information you provided will be helpful in every walk of life.

CONGRATS!!!!!

Beverly, thanks for reading and for your comment. You’ve always been one of my biggest cheerleaders. 🙂 I appreciate it.

Great Info!! I will be sure to share this info with my Real Estate Clients!! When trying to buy a new home clients are always looking for ways to increase their score to get the BEST interest rates and this will surely assist with that!!!!

Thanks for sharing!!

Thanks for reading and for your comment!

Thank you for the advice. I need some advice on how to reinvest a withdrawal recently from my 401k to payoff our mortgage. How do I chose a financial advisor I can trust? Will that be something you blog about?

Hello Kathy, thank you for reading the blog and for your comment.

I can certainly blog about how to choose a financial advisor. In fact, I will make that my next blog topic.

Off the top of my head: You want to choose a fee-based rather than a commission-based financial advisor. A fee-based advisor is paid a set fee for their advice while a commission-based advisor is compensated depending on which products they sell to you. So of course, that typically means the unscrupulous ones will sell you the products with the highest commission rate rather than the best one for your financial situation.

Therefore, the first question to ask is how the financial advisor is compensated.

Outside of that, you might want to check them out first using the website: http://www.brightscope.com.

Good luck and let me know how I can help further.

Severine

I found out about your blog in Evelyn P’s group and decided to check it out. I’m impressed. I had no clue how the Credit Scores were calculated. Thank you for the information.

Hi Crystal, thank you for reading the blog. I’m glad that you found it useful. Severine

Dr. Sev.. I should have talked to you before my house went. We have to schedule a Lonnnnnngggg telephone conference.

Great site and I am looking forward to reading and learning more

Cilla, thanks for reading. It’s my pleasure to serve. I will text you so we can arrange a time to chat.

Good Morning, I could have used this advice a few years ago in the midst of getting a divorce and husband who had me bouncing checks faster than my paycheck could hit the bank. I didn’t give up my house but my car so that I could keep my house. I saw my credit score go to the toilet. Fast forward a few years, I have reestablished my credit, my score is over 600. I have credit cards that I use on a rotating base. I have also made it a practice to pay cash. I enjoyed the blog will continue to read to learn more.

Hi Toni, thanks for reading and sharing your experience. I am so sorry you went through that. There are many of us out there. But we are resilient and will bounce back!

I will do my best to continue to share subjects that educate and inspire.

Great read thanks for sharing your knowledge that we can improve our life thanks Blessings.

Sydney, thanks for reading and for your comment. I hope to continue to use this vehicle to be a blessing.

Hey Severine, very honest and informative. I love your blog.

Barbara, thanks for reading and for your encouraging comment.

Hello Severine, I have just finished reading the intro to your financial blog, and must tell you it has re-awoken the desire to focus more on my retirement funds,final expenses, and just taking more of a sterner control over my finances. I look to hear more from you on these subjects soon! God bless you and congrats on moving forward in your vision!

Rose

Rose, thank you for reading. It is my pleasure to serve in this capacity!

Absolutely love this!!! Amazing!!! I have first hand learned so much from you. Excited about all you will share with the world.

Maja, thanks so much for reading and for your support!

Thanks for much for sharing your blog! Thanks for explaining the way credit scores are determined.

Ms. Ev,

Thanks for reading. I appreciate your support. 🙂

Severine, thanks so much for the information. I too had a similar experience, and I am now using the principles you stated to improve my credit. Good luck with your Blog. I will continue to read your posts.

Hi Maria, thanks for reading and for your comment. It’s upward and onward from here for you and me! Best of wishes on your journey. It is my hope that the nuggets I share help others on their journey to financial freedom.

Your blog is very informative. Most of the information that you shared in the blog seems to be hidden. Thank you for your transparency and your passion to educate people. There are some golden nuggets that you brought clarity and in-depth explanation. I’ll definitely share with some people. Blessings!

Angela, thanks for reading and for your encouragement. It is my hope that this blog space remains an information station. Thanks for sharing. Sharing is caring 😁 so hopefully they’ll appreciate your efforts.

Severine